CLARITY UP FRONT

- Geopolitics tops the list of immediate concerns for global business leaders.It impacts everything from supply chains and operational resilience to people security and new market entry and exit.

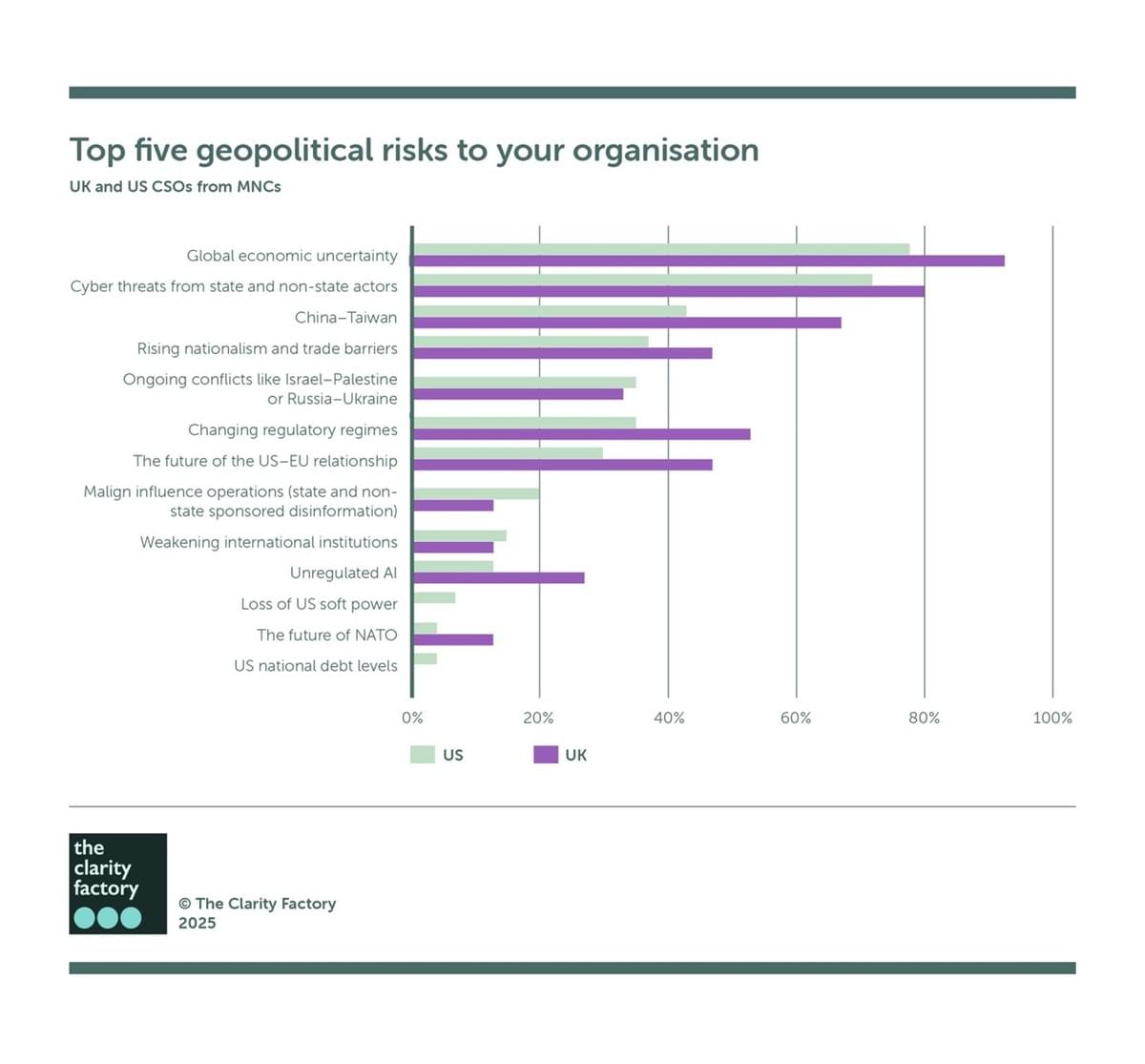

- Geopolitics is a major concern for CSOs and their teams, who rank global economic uncertainty, cyber threats from state and non-state actors, and China-Taiwan as the top geopolitical challenges impacting their company.

- Corporate security intelligence can generate useful insights for other business processes, and executives increasingly recognise the value of corporate security intelligence.

- Many corporate security intelligence teams find it difficult to make the leap from operationally focused security intelligence to intelligence-informed business insights.

- Clarity Factory data shows untapped potential for intelligence influence in relation to

supply chain and cyber security. - Corporate security is not alone in being able to contribute to geopolitical insight, and it must find practical and sustainable ways to join forces with other teams, including external relations, government affairs, corporate affairs, community relations, supply chain, enterprise risk management, and business intelligence to give leaders a full picture of the geopolitical outlook for the company.

C-SUITE CONCERNS ABOUT GEOPOLITICS

Geopolitics is consistently ranked by senior business leaders as one of the key risks facing their corporations. As Saadia Zahidi, Managing Director of the World Economic Forum, put it, ‘Today, geopolitics – and specifically the perception that conflicts could worsen or spread – tops the list of immediate concern. Geopolitics impacts everything from supply chains and operational resilience to people security and new market entry or exit.'

Executives expect heightened volatility in the decade ahead. As one C-Suite member told The Clarity Factory, ‘The geopolitical axis is forever twisting and turning, which makes it somewhat unpredictable. It can be all good today, and then up in arms tomorrow.’

GEOPOLITICS AND CORPORATE SECURITY

In Clarity Factory surveys, CSOs consistently rank geopolitical risk as one of the top three security risks impacting their organisation, and in our 2025 Annual CSO Survey they told us the key geopolitical risks impacting their company are global economic uncertainty, cyber threats from state and non-state actors, and China–Taiwan.

THE BUSINESS VALUE OF CORPORATE SECURITY INTELLIGENCE

In a complex global business environment, multinational companies require more nuanced insight to drive better decision-making. In recent years, C-Suites have met this challenge by investing more time and money in geopolitical analysis, board advisors, and board members with relevant experience and networks.

They also increasingly recognise the value of corporate security intelligence; a majority (52%) of those surveyed by PwC said they would like more security intelligence skills within their corporate security function, and a CFO told The Clarity Factory, ‘I think intelligence is critical, because it’s the foundation from which we can do everything else.’

Many corporate security functions have sophisticated and well-resourced intelligence teams that provide a wide range of information, intelligence, and analysis – from tactical to more strategic. More than two-thirds of CSOs have professionally trained intelligence analysts on their team, and respondents to our 2025 Annual CSO Survey told us that intelligence capability is one of the key areas of staffing investment for 2026.

FROM SECURITY INTELLIGENCE TO INTELLIGENCE-INFORMED BUSINESS INSIGHT

Some corporate security intelligence teams include finely-honed geopolitical expertise that can be harnessed by the business to inform decisions and future strategy, but for most this remains aspirational. Many find it difficult to make the leap from operationally focused security intelligence to intelligence-informed business insights.

CSOs looking to apply corporate security intelligence to business needs should:

- Position corporate security intelligence as a business asset, not just a functional one.

- Identify ways to connect intelligence data with data from other parts of the business, such as operations, supply chain, and cybersecurity. As one CSO told us, ‘You can’t assess risk if you don’t have the internal data that enables you to understand the impact of security incidents.’

- Find ways to connect analysts with the business, e.g.working groups or rotations, or situating them within the business rather than in the corporate security team. Analysts cannot be expected to produce business-aligned insights without exposure to the business.

CORPORATE SECURITY INTELLIGENCE : UNTAPPED OPPORTUNITIES

CSOs report that their intelligence products reach a wide range of internal clients, including business leaders, the C-Suite, and enterprise risk management colleagues. Our data highlights two untapped opportunities:

- Supply chain: As a result of shifting geopolitics, almost half of CEOs surveyed by PwC said they were considering adjusting supply chains, and in another study, three-quarters cited supply chain security as one of the main challenges facing corporate security in the next five years. Corporate security has vital intelligence and data that can improve insight on critical supply chain decisions, but fewer than half (48%) of CSOs identified supply chain as an end user for their intelligence products.

- Cyber security: CSOs rank cyber security attacks as the top security risk impacting their company. Criminals, terrorists, and nation state actors work across physical and digital domains conducting everything from espionage and intellectual property theft to fraud and threats to senior executives. A siloed approach in the face of joined-up security threats leaves companies exposed – yet only 43% of corporate security intelligence teams target their products for cyber security end users.

CREATING AN ORGANISATION-WIDE INTELLIGENCE AND INSIGHT CAPABILITY

Corporate security is not alone in being able to offer geopolitical insights. According to research from the Belfer Center at Harvard University, corporate security accounts for around one-quarter (23%) of all corporate intelligence. A range of other functions, including external relations, government affairs, corporate affairs, community relations, supply chain, enterprise risk management and business intelligence have complementary knowledge, networks and expertise that can be put to the service of senior business leaders grappling with the consequences of geopolitics.

There is potential to create much more nuanced insight through closer collaboration between intelligence functions across the business, and some CSOs have brought these strands together in a fusion model to enable intelligence-driven decision making in relation to supply chain, de-risking of product cycles, enhanced visibility of risks related to new market/country entry and M&A/divestment activities, and insights around stakeholders. These insights could also feed into ESG efforts.

CSOs looking to position their intelligence capability as a business asset and work with insight partners across the organisation must address the following questions:

- Business needs: what information does the business need, how do needs differ across role and geography, and what kinds of products does the business want?

- Stakeholder mapping and coordination: which colleagues have geopolitical expertise to offer, and what are the most effective ways to coordinate efforts to avoid duplication, confusion or conflict?

- Information management: how can sensitive data sources be shared?

- Risk calibration: how can we stay up to date on business risk appetite to ensure recommendations are proportionate?

- Governance: what are the best practices in governance for cross-company collaboration and information sharing?

- Talent: what skills and expertise are needed within the corporate security intelligence team to deliver effective business-focused geopolitical analysis?

Corporate security intelligence capability can be a critical business asset in a global operating environment characterised by volatility and geopolitical instability. To deliver genuine value, CSOs must:

- Position corporate security intelligence as a business asset.

- Provide intelligence analysts with exposure to the business.

- Identify practical ways to serve critical partnerships, such as supply chain or cyber security.

- Build coalitions with partners across the business who have knowledge to add to the company’s geopolitical insight, and work through the challenges of information sharing, risk calibration, products,

and governance.